A CIECA webinar audience recently learned about artificial intelligence (AI) in collision repair and the possibilities it brings across the claims process. Abhijeet Gulati, senior director of artificial intelligence and machine learning engineering at Mitchell International, and Gaurav Mendiratta, CEO of SocioSquares and chief product officer at Propel, gave their insights on the evolution of AI and the role it will play in the collision industry customer experience moving forward.

Evolution of AI

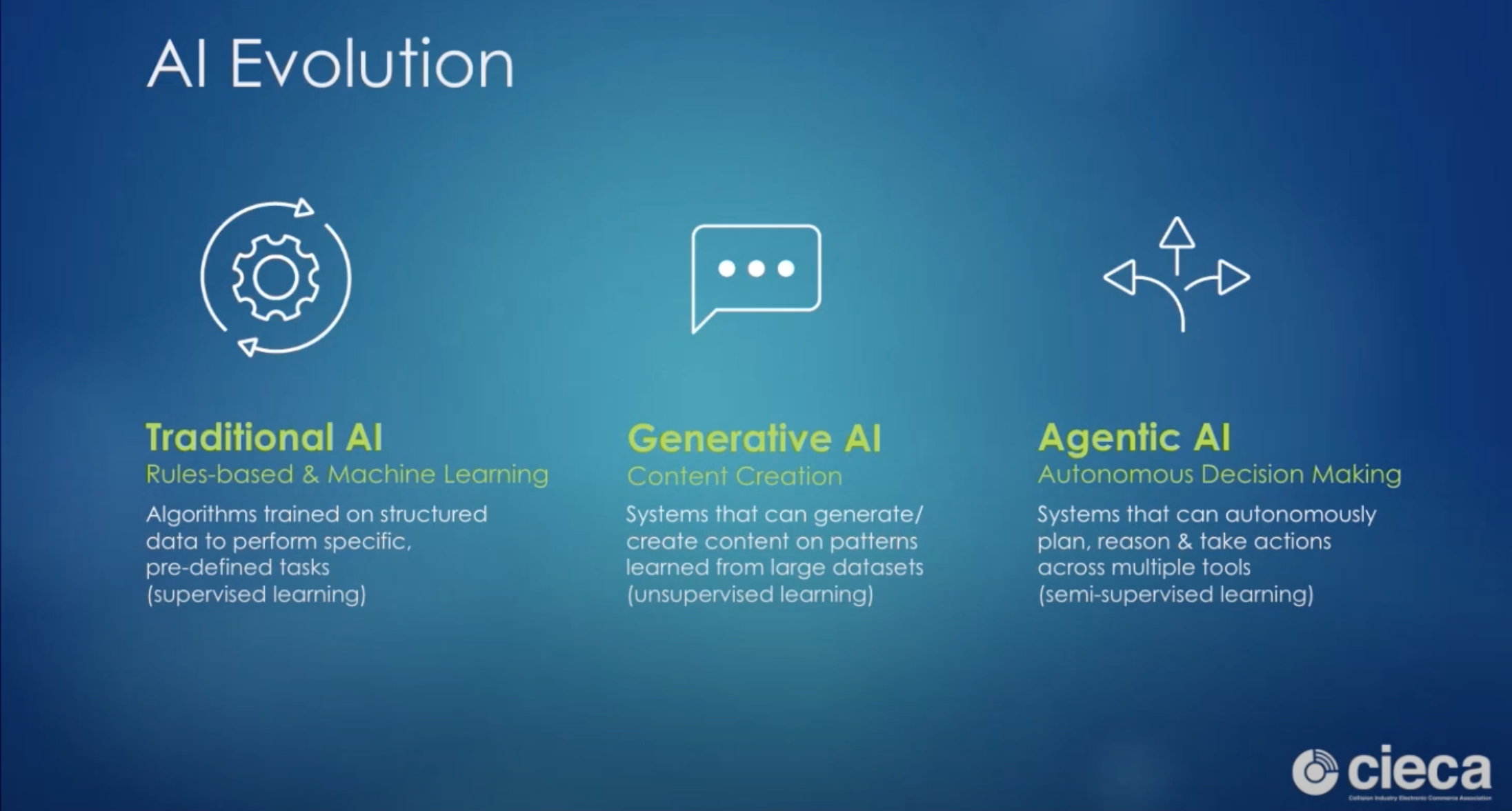

It’s important to understand how AI has evolved, Gulati said. It began as a root-based system — purely supervised machine learning, which in the collision industry, could assist in classifying damages, predicting repair costs and detecting fraud. This generation of AI was trained based on predefined specific tasks and driven through supervised learning. It could do things like prepare documentation or personalized customer communications through learning patterns from large data sets or large language models.

The AI evolution has jumped from traditional to generative to agentic models. Images courtesy of CEICA.

The AI evolution has jumped from traditional to generative to agentic models. Images courtesy of CEICA.

Next came generative AI, which made the jump to content generation, and the next evolutionary step, he said, was a “quantum leap” to agentic AI, with systems autonomously planning and taking action.

Information retrieval gaps, data collection that takes time, and inconsistent or erroneous decisions in assignment all slow down the claims process, Gulati said. The aforementioned stages of AI evolution helped address these friction points in varying ways.

Traditional AI in collision repair involved automatic damage detection using computer vision capabilities like optical character recognition, which helped at the point of collection of information. Computer vision-based damage assessed photos, for example, he said, could help in triaging decisions on repair or total loss declarations or estimation of repair labor hours.

Generative AI can help with things like estimate explanations and documentation of repair procedures using natural language interfaces.

Agentic AI allows for use of different artificial agents functioning to produce processes like conversation, information retrieval and auto initiating of scheduling while adapting to customer responses along the way. The three generations, Gulati projected, will likely continue to be used in harmony.

“They are systems that can orchestrate and coordinate a complex multiple checkpoint task and request information at the right point in time to move the claims process along,” he said. “From a customer experience point of view, we are going to see traditional generative and agentic coming together to solve challenges within our industry.”

Looking at changes to customer service and AI in the past 12 months, Mendiratta said it’s apparent that language models have not only grown, but they’ve become “smarter, faster, cheaper and way more useful.”

A year ago, he said, most large language models could handle maybe a few hundred pages of input. Today, some can read and understand PDFs with more than 3,500 pages — real-life scenarios like whole reports, long email threads or complete call transcripts.

“It's not just about memory,” Mendiratta said. “It's about reasoning features like think mode or deep research that give AI the ability to pause, reflect and cite sources, and this delivers fewer hallucinations and much more helpful answers.”

These points of risk management are essential in the development of AI and its applications in the claims process.

These points of risk management are essential in the development of AI and its applications in the claims process.

Top models are using multimodal intelligence, meaning they aren’t just reading — they’re seeing and hearing, too. This means they can accept image and voice input in one workflow. Large language models, Mendiratta said, have also gotten “lighter on their feet,” producing faster results and using less energy.

Mendiratta used an AI-generated version of himself to pivot to creative AI and discuss the biggest breakthroughs in the past 12 months. Creation of art from text quickly allowed AI users to generate images and video. Use of image prompts now allows for creation of animation, which when paired with 3D printing, has allowed users to generate merchandise. Mendiratta said live interactive video avatars could be common in customer service soon.

Next Steps in AI

The jump from generative to agentic AI requires supervised learning and structured data from a human — maybe asking how to write an email, Gulati said. Agentic AI is more task-based — it may formulate an email and actually send it once a human has reviewed it. It will transform the collision industry by executing multi-stop processes autonomously and making contextual decisions within human-defined boundaries.

In this context, AI agents could coordinate complex actions between industry players like repairers and insurance adjusters and carriers as an “orchestration layer,” Gulati said. AI can also maintain audit trails that document actions and decisions, and it can adjust to regulatory changes in the industry.

Agentic AI will likely join industry functions in conglomeration with generative and traditional functions because users will still need computer vision to define damage classifications, and there will still need to be repair procedure documentation, but agentic AI will likely take over execution of specific tasks.

AI use cases in collision repair run the gamut of the claims process, Mendiratta said. It can look like processing and the collection of information through an AI retrieval bot that can validate insurance coverage and gather documentation.

Repair coordination via scheduling agents — managing inventory or supply chain or parts — is another use case.

Agentic AI can be applied across the claims process to aid in certain key steps.

Agentic AI can be applied across the claims process to aid in certain key steps.

AI agents can also look out for fraud and abuse during the claims process, measuring risks and suspicious data patterns. There would be multiple touch points in this case, Mendiratta said, where a human could direct the next course of action.

Decision transparency is a “fundamental pillar” as the industry looks to build in agentic AI solutions, Mendiratta said. It allows users to understand decisions AI makes and to ensure they are occurring at the desired levels of detail.

“We want to make sure our systems are reliable and predictable across different scenarios, so basically what that means is within the confines of the guardrails, we want to make sure that the responses and the outcomes are consistent,” he said.

He emphasized that instead of replacing humans, agentic AI use will depend significantly on human decision making at necessary points to build trust in the system and provide feedback.

One of the biggest challenges facing the collision industry as it implements AI is fraud, Gulati said. He cited an example Mendiratta brought up of AI image production that incorporated scratches and dents on a bumper that would be hard for shops and insurance companies to identify as fraud. Because of workarounds like these, he said, resilient fraud identification systems are essential moving forward.

As AI systems gain autonomy, a robust risk management framework is a must, Mendiratta said. In regulated industries, Gulati pointed out, there are multiple dimensions of risk, such as secure handling of data like personal financial information.

“We need to continuously monitor these decision patterns that are coming about to ensure that there are no data drift or decays that are happening within the system, and if there are anomalies that we have systems that will flag those for us,” he said.

Mindset Moving Forward

Moving forward, Mendiratta suggested industry members “have a slightly different mindset” around implementation of AI in collision repair.

“I think the right mindset to approach is that AI is not going to replace the human; it will increase the efficiency,” he said. “Instead of going after 100% accuracy and trying to make sure that the AI does everything a human does, we have to focus on, ‘OK, can it do a certain task 50% better and do that with 90% accuracy and the human is still running all the other tasks and AI is managing that one small task, and that will reduce cost that will improve customer satisfaction?’”

The real peril is for companies that fail to get in the game.

“Yes, there are risks in AI, and we need to manage them thoughtfully,” Mendiratta said. “But here's the real risk if we don't start using AI: the people and companies who do will replace us.”

Elizabeth Green