Artificial intelligence-based pre-scan product makers are pushing farther into collision repair. Companies have talked it up for years but focused on insurance company use and mechanical shops, often at dealer groups, or a few big fish clients. That’s changing.

Israeli late-stage start-up UVeye has some $390 million in debt and equity backing, including from carmakers. Hertz will use its hardware; Amazon was already onboard. It’s in 500 sites in North America, including 300 at auto dealers, and wants more body shops.

UK-based Tractable since July has been adopted by shops and MSOs in Canada with 35 locations using its software. The company’s approach differs from UVeye, and it has worked with insurance, operations software makers, and auto parts providers. Crunchbase said it’s raised $185 million, including from SoftBank.

Norway-based Wenn is coming to America with, like UVeye, a hardware system. It’s initially aimed at parking and rental car layouts at airports. It, too, wants to talk with collision industry operators, its CEO said. Wenn collaborates with Tractable on some work.

BayWatch Technologies in Utah has fresh funding and a hardware price it thinks pencils-out better for more shop owners. An ex-Toyota exec is a public face of the firm, founded by tech-tinkering college students; the exec said it’s nearing a deal with an MSO of about a dozen units.

All in, at least a dozen firms, including several overseas, have worked on AI-based scan tools, though it’s not known how many will try for body shops. Companies doing scan-related work, such as Kinetic Automation in California—focused on the other AI bookend, post-repair calibration—and Solera are adjacently active.

Big Players, Skepticism

AI pre-scans have wended their way toward the industry by other routes for about six years. CCC and Mitchell are in the space. Tractable by 2021 was working with Mitchell and insurer Hartford Group, and USAA had by then been developing an AI photo processing system for two years with Google, The Wall Street Journal said.

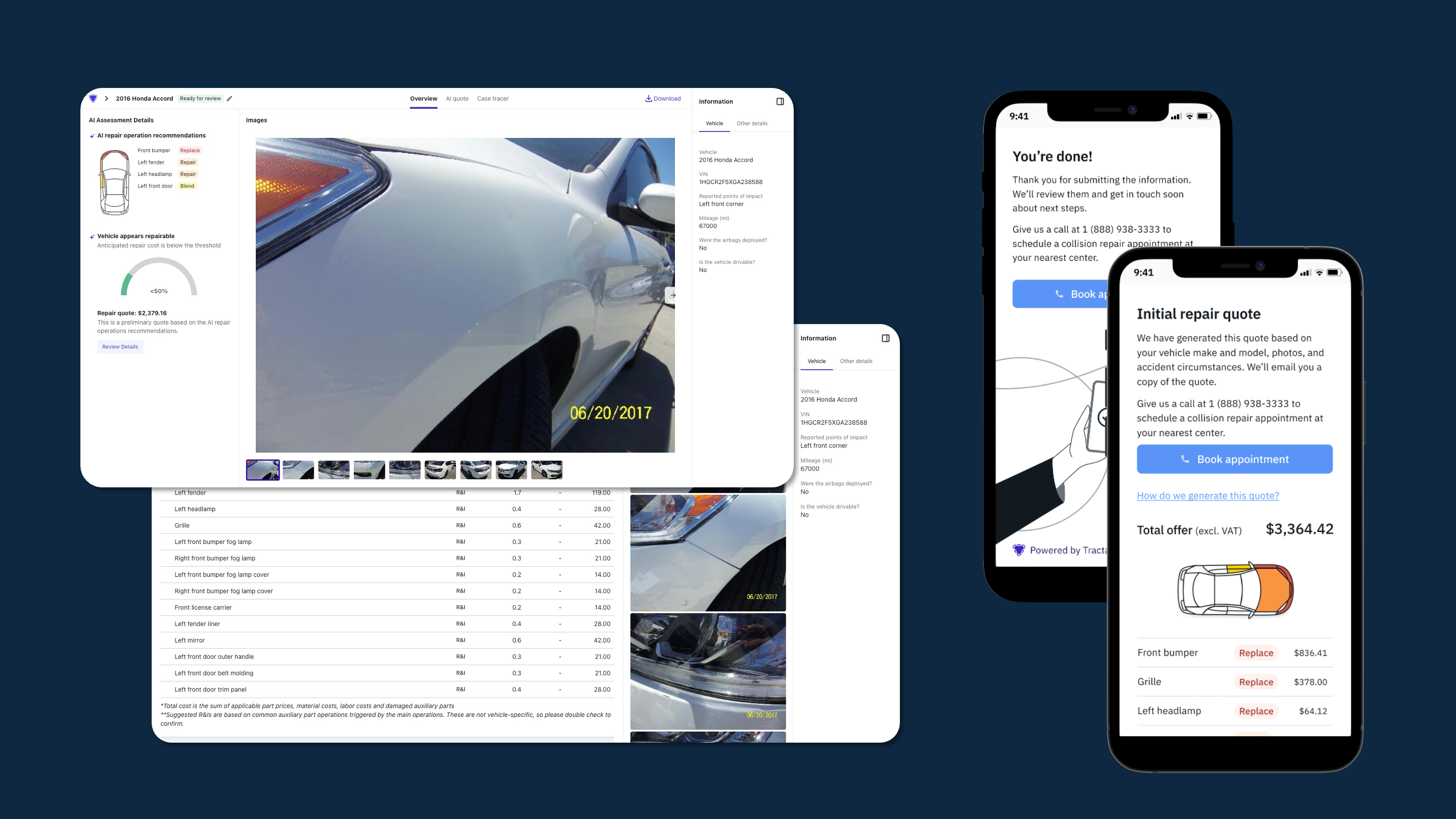

Tractable's output.

Tractable's output.

Companies targeted fleet operators for Amazon delivery or rental cars, or dealerships seeking customer service at entry or upsell work findable by systems’ cameras—PDR-level dents, wheel anomalies, undercarriage leaks. Couple that with suspicion of a product pursued by insurers and AI generally, and body shops weren’t directly part of the discussion. Little’s been said to them, and more’s been said than done.

Some operators Autobody News spoke with knew about the tech efforts of course but hadn’t heard of specific companies. Others balked at cost. Hardware isn’t cheap, and even lower-cost, hand-held hopefuls must prove their presence matches their promise. Shops are aware, have heard of early iterations, and haven’t signed on.

Another hurdle: what do systems actually do and how well? A trades report last year on Tom Wood Group, a car dealership network in Indiana, noted the AI system it installed didn’t at the time find some ADAS sensor damage. An initial estimate also is just that; the products aren’t X-rays.

Will they save time? Replace photo-taking by humans for efficient staffing? Help with validating repairs? Protect shops with picture evidence of their work? Bring in business?

Collision center owners and operators so far have largely taken the wait-and-see skepticism of later adopters.

Software Maker Fills Sales Funnel for Young Indie Owner

“We started with insurance,” said Mitch Anderson, who leads growth strategy for Tractable. He’s worked at insurer AIG and consultancy Deloitte. Over the last 18 months, Tractable “revamped the body shop offering.”

He and Jimmy Spears, head of automotive AI, have “a lot of industry people on the team,” he said. Spears has years in the work, at USAA and on CIECA and CIC committees.

Tractable targets “smaller shops, small, family MSOs” that can decide fast, Anderson said. Software isn’t tied to a hardware buy: it can run on mobile devices to detect and estimate damage.

“They’ll buy Tractable because they have a cell phone,” Spears said. Insurers, recyclers, fleets and OEMS use it. They said shops can see it as a way to boost business and streamline intake. Images produce a quote within 30 seconds, and software can be “white-labeled” to the shop.

Anderson: “You want to be the first one that interacts with the customer.”

Tractable has been adding contracts, especially in Canada. Press materials said users include Kirmac Collision, with 20 sites; four units under Zenetec Collision; Saputo Capital Collision, also four; and Don-Mor CARSTAR.

Brett Campbell.

Brett Campbell.

Brett Campbell bought City Centre Collision in Ontario in November and started with Tractable in March, as it began to be integrated with his operations software, Nexsyis. The 12,000-square-foot shop has 15 employees and sees 60 to 100 cars a month, with no DRPs. It’s a member of Certified Collision Group.

“It’s a lead-generator,” he said, exuberant about his options. “It’s quick. We get all the photos we need for an estimate.” With how he’s getting the word out, City Centre can reach prospects before they call insurance. He said people understand estimates can change after tear-down.

He’s left fliers with links to his software at dealerships and the police station, the latter for people involved in a collision they’re reporting. Dealers use it for trade-ins — “they can drag the photos into the link” — and others are walk-ins. “People call or drive in and say, ‘Hey, can you give me an estimate.’”

He’s done some 100 estimates “and one-third to one-half have produced jobs.” He expects an uptick from Toyota OEM certification he’s completing; the shop link will go into new-owner packets. He pays $500 a month for Tractable.

Its entry-level interface is $299, Anderson said, “$499 is a workhorse.”

“We’re just on it,” Campbell said. “Bottom line, it’s just plain cool.”

Hardware Maker Deep Into Dealers, Including Collision

At the far end of a shop spectrum from City Centre could be Tom Wood Group’s two dozen offerings across a spectrum of vehicle types and services, including multiple automobile brands; dealerships feed its Tom Wood Collision at 75,000 square feet. The company’s nearing three years using UVeye.

“We started with mechanical, but immediately saw the collision opportunity,” said Tom Wood Group’s Director of Fixed Operations William Demaree. “We’re always looking for the next thing that’s going to help us get better.”

William Demaree.

William Demaree.

It’s also helped them get bigger.

“We set-up in-house PDR and now have three paint booths in our dealerships,” Demaree said. Pictures show problems, and numbers from a recent month reciprocate with a snapshot of results.

The shop’s drive-thru hardware found 36 bulging or expired tires, 298 damaged wheels, 29 vehicles needing alignment. Same month group totals: 1,642 unsafe tires, 42,000 damaged rims or wheels, and 3,621 vehicles for alignment.

“29.3% of vehicles that came through the system had something owners didn’t know about,” he said. AI-scans have bested blueprinted reports. Scans document car condition when it leaves a lot—the customer’s or rentals and loaners. “That’s been huge for us.”

He lauds the cost-benefit: “A revenue stream we’d never done anything about. It’s a model that works.” But first it’s a cost. UVeye hardware hews to the far end of the product spectrum from Tractable software.

Marketing director Yaron Saghiv pegged installation in the mid to high four figures with similar monthly costs for SaaS use. Dealership groups and fleets have been its first targets. Larger collision centers and MSOs could have the needed volume; some others could find a way to make it work.

Yaron Saghiv.

Yaron Saghiv.

“Our equipment and technology is modular, installed today in different use cases depending on the lifecycle of the vehicle,” Saghiv said. Dealerships are, so far, UVeye’s bread and butter. It’s in indie shops, but “100 cars a month isn’t enough.”

The system itself requires little space—under 14 feet, any direction—and does yeoman’s labor collecting data, as witness Demaree’s precise reports, available in seconds.

Collision center benefits coalesce around time and experience, Saghiv said: faster estimates, quickly accessible information, including insurance, cutting wait times and improving interactions.

“Transparency,” he said. “Not necessarily someone ‘explaining’ but showing, giving knowledge to consumers. Everyone wants the same thing: to understand what’s wrong with the car.”

Patriot Subaru of Saco, in Maine; Mercedes-Benz of Manhattan, and Carl Black Chevrolet in Orlando have also used UVeye.

Price, Partnering, Part of Something Else

Rick Leos led predictive collision estimating teams a decade ago at Toyota. Now he owns part of BayWatch, begun as a 2017 project at BYU. Founders Caleb Wagner and Tanner Beckstrand remain with it as “young workhorses; I do all the talking and find the money,” said Leos, whose formal title is chief revenue officer.

He said the company has raised $1.2 million from private investors, including a seed round in 2018, according to Crunchbase, and will soon hit $2 million. It’s in collision centers at some 250 dealerships, including Asbury Automotive Group locations, and a rental car company—“not Hertz.”

Not Enterprise either, at least not yet. “We were prototyping with them pre-COVID and might” try again.

Set BayWatch mid-range on price. Installation is free; entry-level monthly is $1,900 or “$3,300 fully loaded.”

Leos said the hardware, roughly similar to UVeye on method, is small—3 feet, any direction—and uses infrared: red lights, not white. “Like walking outta CVS.” Unlike UVeye, it doesn’t see underneath cars.

An undercarriage view isn’t needed “with all the black panels on the bottom—my personal opinion after 35 years in the business. BMWs are so buttoned up, you wouldn’t know [what’s wrong] until you took it apart.”

BayWatch recently updated its system, and is hitting trade shows. Leos said a pencil eraser is 5 mm; the new version can detect dents to 3 mm, “and we think we can cut that in half.”

Leos said BayWatch had 500 units on order pre-tariff turmoil. The system cooperates with estimating software. “It’s the client’s choice: CCC, Tractable, whatever they want, any direction or format.”

Norway-based Wenn—also hardware, fleet-focused, specializing in airport rental lots and long-term parking—partners with Tractable when clients want estimates. Wenn takes the photos; Tractable gives the costs.

CEO and co-founder Trygve Pedersen told Autobody News the company, now in eight countries in Europe, will enter the U.S. Pedersen will run Wenn Inc., the new venture.

Pedersen declined to name initial locations or pin down a price, he said: they sell or lease systems, charge per car, and installation expense depends on projected volume. He said the system can handle any level of traffic.

“Initially we’re focusing on rental operations but we’re more than happy to talk to anyone,” he said. “Anyone that has the need to document” vehicle condition or damage, coming and going. It’s raised at least $7 million.

Wenn’s largest location is in Munich; it’s at dealerships and mechanical repair, along with body shops.

“If I owned the body shop, I’d put it outside,” he said. “Let customers drive through 24/7.”

Solera touches AI estimating with an element of its risk management and asset protection software, according to a Collision Vision podcast sit-down on sustainability with Cole Strandberg. Solera’s Bill Brower said the “capture” tool delivers repair-or-replace comparisons, and other data. Its “intelligent triage” uses AI to predict within 10 seconds whether a damaged car will be totaled. Full workflow can see improvement, Brower said.

Industry Opportunities, and a Couple Questions

Florida Autobody Association President Drew Bryant said members have discussed AI-scans but sees most activity coming from larger shops—with one exception now, and perhaps another for the future.

“In the right hands, it could be a good thing,” he said.

Where he sees opportunity is for body shops to hit the bricks and talk to dealers who don’t have collision but are prime targets for the hardware. Call it a wider-reaching version of the Wenn-Tractable relationship, when dealers scan a car and the shop gives an estimate and does the work.

Figuring a conservative 100 cars a day, Bryant said 41% of those 10,322 vehicles a year have collision damage not being captured. And Mike Anderson calls capture rate a shop’s “single most important KPI.”

“Any dealership that doesn’t have a shop, they’re referring that work out,” Bryant said. Walking the streets to talk with dealers is one way Bryant grew his operations, soon to include an indie ADAS offering for shops and dealers in the area.

Demaree saw 47,263 referable events in a month in Tom Wood’s network. Anderson has seen photos there and “was very impressed,” while tempering his enthusiasm due to price. Wood and Bryant are thinking a similar thought, with a different conclusion on who should do the work.

Leos said, “almost every car is PDR,” and thousands of dollars are being lost monthly not fixing it. That upsell to PDR by a dealer’s in-house shop, or referring it out to a collision center, should be common, he said, “but they don’t talk to each other.” He works with Avis and shops that installed BayWatch, who refer PDR out to Dent Wizard.

Here might be the road by which MSOs get into the act. Dealership groups in Nebraska who’d need multiple collision locations to refer to could work with, say, Eustis or Levander’s. Multi-unit dealers in Utah running BayWatch perhaps, could partner with Quality Collision Group’s OEM-centric Cascade brand in that state.

Bryant said all this contributes to better and safer repairs as shops focus on OEM parts, and dealers at various nameplates connect with collision centers certified for those brands. He said OEMs and insurers at some point also might require AI-scans “for documentation or quality control.”

Positive interactions at shops, with live technicians that will always be required for anything below the surface of what AI can see—“we’re not there yet; were working on it,” Leos said of X-ray quality info—will feed a cycle of those customers returning to build relationships at the auto dealer who referred them to the body shop.

Bryant also echoed Pedersen’s notion about “after-hours service capture.”

AI Everywhere; Wary of Taking a Drink

With OEM parts and dealer groups, carmakers could get involved at the national level.

“Manufacturers that are vested, and understand it, and are innovative and trendsetting—they will do this,” Bryant said. Automakers have invested in UVeye, including venture capital arms of Toyota, GM, Hyundai and Volvo.

He said shops remain skeptical, and a little leery of AI’s implications. Is it a “good which” or a bad one?

Anderson is mostly a fan. “As an industry, we need to embrace technology; when it first enters, it’s the worst it will ever be; it gets better from there,” he said.

Same time, a recent episode of “On the Road” affirmed his view that comprehensive OEM-based scans are the sine qua non for collision shops. “None of the AI I’ve seen writes an estimate the way I write it,” he said.

“People want an ‘easy’ button. You have to do it with caution.” Should we, he asked, only partly rhetorically, “put customer data out there” beyond a shop’s confines, for instance.

“It’s AI + HI, right? Artificial intelligence and human interaction,” he said. “You have to validate it.”

Attorneys, for instance, are being fined for error-laden case law citations generated by AI. On the other hand, Allstate found AI-generated letters to policy holders were more polite than ones written by human, according to The Wall Street Journal.

Many industry companies see “touchless” claims processes leading to fully digital workflows. Companies here are working the front end; others like Kinetic are presently post-repair; with, say, Solera taking the big picture.

Talking with companies, fanciful options arose. Could consumers drive demand, as now exists with a CARFAX report or appraisals prior to home sales, for instance. They might want to see everything right-now-wrong with a vehicle. What about franchised or independent offerings of just the scans—24/7 as noted, customers driving through like an oil change to be funneled to area shops, as Kinetic does now with calibration.

Other implications: safety, post-repair inspection, legal issues, ADAS and wider, general shop adoption of AI.

AI will be integral. Journals tracking automotive research—where commercialization is five to 10 years away or more—brim with accounts of it. CNBC recently said 40% of venture money raised in 2024 aimed at AI.

Paul Hughes