The latest episode of “On the Road with Mike Anderson – Serving Up Collision Advice” focused on “all things scanning,” including Anderson’s strong opinions on OEM vs. aftermarket scan tools and recent agreements between scan tool makers and insurance companies.

The episode aired live May 12 and is now available on-demand on Autobody News' YouTube channel.

More Shops Getting Paid for Some Scans, but Missing Others

Anderson opened the episode with an overview of the three scans required for a complete repair -- pre-, in-process and post-repair.

Pre-scans are performed before disassembly to identify vehicle build data, check the battery level, and find “freeze frame” or key cycle data to determine which DTCs are related to the claim. They help lower the number of supplements by identifying issues that need to be addressed in the repair plan.

Anderson said the most recent quarterly “Who Pays for What?” surveys, which he conducts in conjunction with CRASH Network, found 90% of shops are getting paid all or most of the time for pre-scans, up 1.1% from a year earlier.

“Awesome job as an industry, we're moving forward with getting paid for pre-scans,” Anderson said.

Post-repair scans, which are performed after test drives and calibrations, can identify or clear out codes triggered when set conditions -- like a specific minimum speed, or putting the vehicle in reverse -- were met during the test drive. Post-repair scans also ensure all of the safety and comfort features are working.

They also had a high success rate for reimbursement -- 91% of shops said they get paid for the post-repair scans, up 1.3% from a year earlier.

However, in-process scans, which are performed after reassembly but before any test drives or calibrations, were a different story: only 29% of shops said they are getting paid for that line item -- a decrease of 5.3% year-over-year -- and 45% to 50% of shops said they never even ask for reimbursement.

“It's my personal belief that most shops are not truly understanding the scan process,” Anderson said.

In-process scans are necessary because they might be needed to re-energize a hybrid or electric vehicle, or they may be required by OEM repair procedures to clear specific DTCs before performing test drives and calibrations. They may also be needed to clear any loss of communication DTCs or bring back online any safety components that may have been turned off.

“There are people in the industry right now that disagree with my use of the word ‘in-process scan,’” Anderson said. “All I got to tell you is, I love you, but get over it. Don't get caught up in the words. Call it whatever you want, OK? But at the end of the day, we need to hook up a diagnostic tool, and we need to perform certain procedures or ensure certain things are done properly, before the vehicle has been on a test drive or before the vehicle has any calibrations done.”

Properly Performing Scans

Anderson went over the proper steps for scanning a vehicle. He said after the vehicle is pulled into the work area, turn on the four-way flashers to keep all of the computers awake. Then the vehicle should be allowed to warm up or cool down to operating temperature.

Next, the battery needs to be hooked up to support for at least 10 minutes before performing a scan.

“Let me just say this right now: a jump box is not battery support, a trickle charger is not battery support,” Anderson said, adding the most common OEM-approved device he is aware of is a Midtronics DCA-8000 diagnostic battery charging system.

Once a “health check” or diagnostic scan is complete, the DTCs can be documented and corresponding “freeze frame” data recorded -- for instance, the time, date, mileage and speed at which the DTC occurred.

Then the live data may have to be checked, when applicable. For instance, Anderson said, Honda and Acura vehicles require live data to be checked because issues related to seat belts or airbags won’t trigger a DTC.

Some OEMs also require verifying the horizontal and vertical axis values, in degrees, for certain ADAS components and then ensuring they’re within the value range specified in its electronic service manual.

“I've seen ADAS components that were out of specification, I've seen steering angle sensors that were out of OEM specs, and there were no DTCs,” Anderson said.

Each DTC then needs to be researched to figure out the most probable cause.

After the repair, the in-process scan is performed, followed by a test drive that reaches the set conditions. Then the post-repair scan can be completed.

Anderson said all steps should be included when charging for labor time.

“The majority of the steps on here are required no matter what kind of vehicle you are scanning,” he said.

Aftermarket vs. OEM Scan Tools

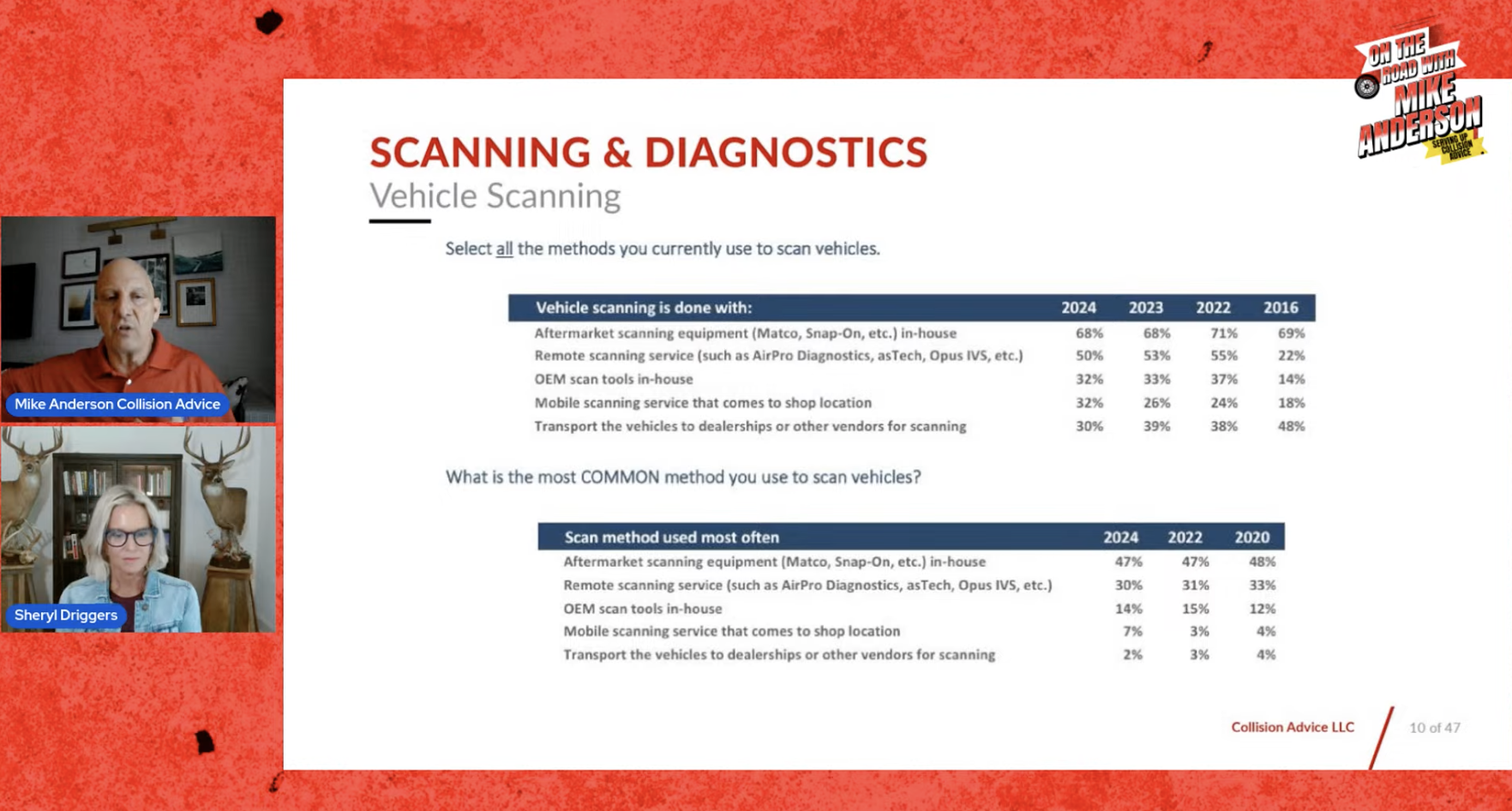

Anderson said the industry as a whole is doing a good job of completing pre- and post-repair scans, but what “freaks me out” is the use of aftermarket scan tools. In 2024, 68% of “Who Pays for What” survey respondents said they used an aftermarket tool.

Mike Anderson and Sheryl Driggers review survey responses about which scan tools shops use.

Mike Anderson and Sheryl Driggers review survey responses about which scan tools shops use.

“I'm going to say it right now. You cannot do a proper scan on a vehicle involved in a collision with an aftermarket scandal. Ain't happening,” Anderson said.

The survey showed 50% of shops used remote scanning services from companies like AirPro Diagnostics, asTech and Opus IVS; 32% had OEM scans tools; 32% used a mobile scanning diagnostic provider; and 30% sent vehicles to a local dealership.

The numbers do not add up to 100% because, for instance, a shop might have a Nissan or Toyota scan tool to perform those scans in-house, but sends Mercedes-Benz vehicles to the dealership.

In the surveys, shops were also asked if they include time needed to research DTCs in their labor time.

“What we saw, ladies and gentlemen, is that 67% of shops, when they charge to scan a vehicle, they're saying that includes their DTC troubleshooting time; 33% of shops said they itemized that separately,” Anderson said.

“If I have a vehicle that has 1 DTC, and a vehicle that's got 16 DTCs, how long it takes me to research 16 DTCs is going to take a lot longer than a car that has one,” he said. “So how are you including that in your scan time and having the same scan labor time on every single vehicle?”

Properly scanning and diagnosing a vehicle is more than “just hooking a scan tool up,” and requires a technician with sufficient training, Anderson said.

“It's about understanding that I may need to go through and pull up certain values and verify them against what's in the OEM repair procedures,” he said. “I think we do ourselves a disservice when we don't talk intelligently, or we don't have the proper person conducting our diagnostic scans. It's not about just doing the scan tool. It's about understanding what are the extra things that I need to do.

“I think our industry thinks, ‘I'm just going to hook up this scan tool and I'm going to see if there's any DTCs and if there's not, everything's OK,’” Anderson added. “Ladies and gentlemen, that is not a safe and proper repair. It is not.”

He said there are several credible training resources, including his own company, Collision Advice, as well as I-CAR, the OEMs, Collision Hub, Kaizen, BETAG, Flatliner and 3M.

Anderson said he expects to hear from haters on his opinion, but he does not think aftermarket scan tools belong in collision repair centers.

He said they can work well in a mechanical repair shop, because when a customer brings in a vehicle, they have a complaint about a specific feature not working -- the car won’t start, the air conditioning isn’t blowing cold air.

“You can use that aftermarket scan tool to determine the cause of that concern. Concern, cause, correction,” Anderson said.

However, when a collision-damaged vehicle comes in, the customer doesn’t know what is wrong. It’s up to the shop to confirm everything that is working or not working on the vehicle in order to write an accurate repair plan.

“The only way to truly confirm everything that's working and not working is when we use an OEM scan tool that has access to the build data,” Anderson said.

OEM scan tools are updated frequently, while aftermarket tools are generally updated two to four times a year, he said.

Some OEM tools integrate with OEM repair procedures, but no aftermarket tool does. “They may integrate with a third party, like ALLDATA, but there is no aftermarket scan tool that integrates directly with the OEM repair procedures,” Anderson said.

OEM tools are also capable of scanning a new model the first day it’s sold, while aftermarket tools have a 12- to 18-month lag.

OEM tools perform an output or functionality test based on the vehicle-specific control units, based off build data, which aftermarket tools can’t access. “[Aftermarket tools] may actually give you what's called a phantom or a ghost code, because it didn't pick up on a specific feature on that vehicle, but that vehicle may not even have that,” Anderson said.

OEM tools can usually pick up on past DTCs, while aftermarket scan tools may not, and can tell if a vehicle is connected to a program like Toyota’s Service Connect. “There is no aftermarket scan tool that can identify or tell me whether a vehicle has a paid telematics subscription,” Anderson said.

Anderson presented five questions shops should ask an aftermarket scan tool manufacturer:

1. Does your scan tool or software have access to the same build data based off the VIN that the OEM scan tool has? If not, how does the tool determine what modules to perform an output or functionality test on?

2. When I plug in your aftermarket scan tool to a Toyota or Lexus, can you tell me if that vehicle's connected to Safety Connect or Service Connect?

3. If your software performs an output functionality and it cannot identify a component that does not exist on the vehicle, what does it do?

4. How often does your software get updates when an OEM makes an update on their scan tool? Do you also make an update the same day, within a week, or is it monthly, quarterly or yearly?

5. When a new 2026 vehicle is sold, whether it's a GM, BMW, Toyota, Ford, Kia, whatever it is, can I scan a brand new 2026 vehicle the first day it's been sold off the parking lot?

“If you have an aftermarket scan tool that says yes to all five of these questions, I would love to know who it was,” Anderson said. “I don't endorse any aftermarket scan tool, but I would consider it if they said they could say yes to all five of those questions.

“That's why, again, only an OEM scan tool for me in the collision repair sector,” he added.

Insurer-Scan Tool Pricing Agreements

Anderson said he “would 100% disagree with the asTech-GEICO [pricing] agreement” announced last year.

“I think that the amount of money that's paid, not even getting into dollars, does not support what I know is required to perform a safe and proper repair,” he said. “That agreed to dollar figure does not support the amount of time that it takes to research DTCs, verify values, and do all the things you need to do.

“I think it is the worst thing in the world for our industry regarding scans and calibrations. I disagree with it. I'm vehemently opposed to it, and I would publicly plea to Repairify [asTech’s parent company] to revisit that,” he said.

He also implored GEICO to “get more educated about this, because it's the wrong thing for the consumer, and I'm concerned what's gonna happen.”

Turning to Opus IVS and State Farm’s agreement, Anderson said “nothing should ever trump the OEM repair procedures in regards to determining what calibrations need to be performed.”

“We're looking for an easy button on something that impacts people's lives,” Anderson said. “People trust these [ADAS] systems to work properly. Automatic emergency breaking is reducing front to rear collisions about 53%, blind spot monitors are reducing collisions by 23%. Don't quote me on those numbers, but that's just off the top of my head. But why would you want to mess with that?

“Learn how to identify the build date on the vehicle, learn what components need to be removed, repaired, replaced that require calibration, and then learn how to research the procedures,” he said.

“At the end of the day, I am truly concerned, not for our industry, but for the consumer, for what these agreements are setting us up for liability,” Anderson said.

“This is no disrespect meant to Opus or State Farm, asTech or GEICO. I'm not trying to be a jerk here. But I'm just saying, can we please get some other people in the room on this conversation? Because I'm just really concerned how this can negatively impact the consumer.”

Anderson said he believes all shops should use OEM repair procedures, scan tools and targets for calibrations.

“Anything short of that, ladies and gentlemen, I think we're setting ourselves up for failure,” he said.

The Next Episode

The next episode of “On the Road with Mike Anderson – Serving Up Collision Advice” will air live at 4 p.m. ET/1 p.m. PT June 9 on Autobody News' social media channels, including YouTube, Facebook, Instagram, LinkedIn and X.

Anderson asked for input on what the audience would like to learn about next: the military incident that inspired Anderson’s convictions; test drives and set conditions; or the future of OEM certifications, including some apps automakers are developing to help customers get the repair process started after a crash.

Email Sheryl Driggers of Collision Advice at sheryl@collisionadvice.com to make your suggestion.

Abby Andrews