Count Ravin AI among firms trying to sell AI-based intro-inspection and pre-estimating services to body shops and collision centers. It joins companies such as Claim Genius and Proov Station, as well as UVeye, Tractable, Wenn and BayWatch Technologies to streamline and fine-tune check-in, and in some cases the “last look” with artificial intelligence.

Eliron Ekstein.

Eliron Ekstein.

The SaaS offering is early in its U.S. entry, having mapped out inroads with repair and insurance providers in Australia and New Zealand, at car auctions, and in a trial run with an unnamed MSO in the U.S.

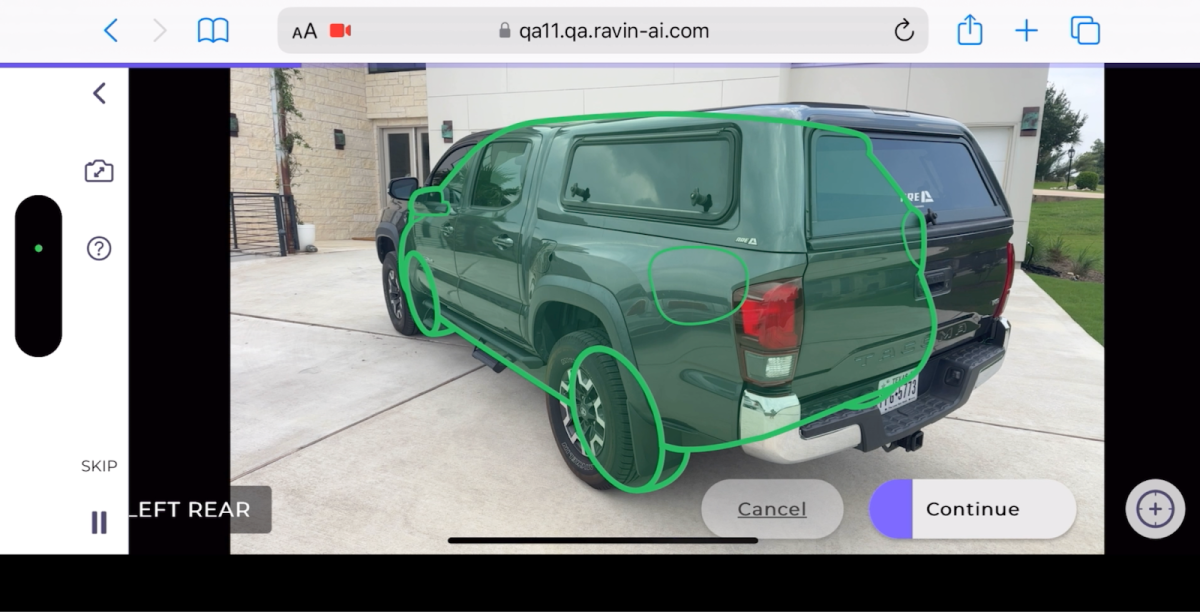

CEO and cofounder Eliron Ekstein said a distinguishing element for Ravin is it doesn’t require the hardware installation needed to work with some companies while producing better images than others relying on handheld devices, such as a smartphone.

“We’re hardware agnostic,” Ekstein said, which could make for less-expensive installation and maintenance. Ravin relies on common CCTV cameras comparable to home or office security equipment as complement to mobile photos.

It’s “more realistic estimates or total loss prediction,” Ekstein said. The software lets shops alter certain aspects of an estimate — “premium or budget repair cost for labor hours” — and is at least partly predictive: particular kinds of damage might generate a “check the suspension” mandate from what the system sees. “You’re using a device as a scanner, not just uploading photos.”

And shops might not need their own cameras at all.

More ways AI Might Work

“This is a consumer facing tool, not just a lead generator,” Ekstein said. Ravin contracts with “resellers” — third-party independent CCTV sites to do the initial scanning as a sales funnel or outsourcing option for shops. This is similar to an idea Wenn CEO Trygve Pederson floated to Autobody News in May: 24/7 scanning sites set up outside of body shops.

Ravin’s early work in Australia has been with “Insurance Australia Group (IAG) and its repair network, demonstrating over 50% reduction in claim cycle time,” according to an email from Chris van der Put, Ravin vice president of sales. He’s heading up the U.S. push; the company’s domestic base is in Austin.

Chris van der Put.

Chris van der Put.

The software has been used “by both consumers and tow truck operators so repairers” get a vehicle preview, so work can get started sooner, van der Put wrote. Ravin has also been used in automobile auctions.

“The U.S. collision repair market is at an inflection point,” he added. “Body shops are under pressure to move faster, reduce manual estimating, and cut down on total loss write-ups that eat up time and margins.”

The above are options. Use directly at a shop or the third-party reseller. It’s installed with car rental franchisees of Avis Budget Group and Hertz Corp., telematics providers, and at a half-dozen U.S. airports.

Ravin’s model and methods are being tried at “one of the larger MSOs, preparing to launch commercially,” along with a few independent shops.

A Crowded Field, and Introductory Industry Awkwardness

Ravin has raised $35 million since its 2018 start, according to Ekstein. Buy-in comes from Shell Ventures, an investing unit of the oil giant; Firemark Ventures, the venture capital arm of that Australian insurer, IAG; and global online auctioneer Openlane.

Ekstein had worked with a Shell team, “looking at ways of monetizing the petrol stations, scanning cars [as an] upsell.” Ravin grew out of that. Like UVeye, its roots are in Israel, where Ekstein is based; van der Put joined a couple months ago from a sales posting with Munich RE, the German multinational reinsurance company. He’s based in Chicago.

Ekstein said via email the company had processed more than 2 billion vehicle images on its patented system.

Such numbers ride the same rails as a presently sexy salvation implicitly pledged by AI, alongside the growing acknowledgment that hype is still hype. And with AI use growing — Autobody News also hears of smaller MSOs with as few as a dozen or so locations deploying in-house systems — shops face a firehose of choices.

As an “opposing viewpoint” side, Ekstein asserted “even CCC has not been able to deploy its AI in a massive way yet,” and Hertz has felt some media heat around its use of the UVeye system. Reporting from the Daily Mail here and here in June cited online response to fees charged renters for apparently minor damage. Hertz said 97% of cars returned incurred no charges. The point: installing the tech comes with risks.

There’s also a firehose of information. It’s still the AI Wild West, but shops will likely participate in — or perhaps lead on? — the new work.

Ravin will be at the 2025 SEMA Show, Ekstein said.

Paul Hughes