Two more companies are looking to join a slew of others offering AI-based assessments and pre-estimates to body shops. As with competitors, each approaches the space somewhat differently.

New Jersey-based Claim Genius software is making inroads with shops, salvage yards and insurers. Hardware provider Proov Station wants larger operators and dealerships.

The first “generates information fast and expedites claims settlements,” said Claim Genius CEO Raj Pofale, “giving an idea of how much time it will take and how much money is involved.”

“This is most profitable for big locations,” said William Balas, who heads marketing for France-based Proov Station. “Big locations and big dealerships.”

Claim Genius is similar to Tractable, Proov Station like UVeye. Software maker BayWatch and hardware from Wenn — a Norway company also entering the U.S. — are in the mix, too.

Is This Genius?

Pofale founded Claim Genius in 2019, following a collision involving his wife. He said the phone calls back and forth and other estimating delays drove his aim to save time and money, flowing naturally from the mind of a former Wall Street tech exec.

The software is running “in the [mechanical] garages and with some of the rental car companies,” Pofale said. It’s being tested in body shops for proof of concept — “how will this expedite inflow and outflow” — and it’s connecting with collision repair via salvage operations and insurance companies as well.

Raj Pofale.

Raj Pofale.

“We’re partnering with recycling companies,” he said. Yards sign on with the software to “bid on more cars and add to inventory. They need to bid the right amount but there’s no scientific way to calculate the value. They need a platform to do damage assessment.”

Otherwise, it’s “a manual process, where you look at every picture and it takes several hours to review cars.” Insurance “uses us to automate policy underwriting,” Pofale said.

Chicago-based insurer Clearcover began doing so this year for “policy pre-inspection” in two states. “Now we’re discussing the next phase — for when that same vehicle comes in for a claim.”

Pofale said the software is also used in India for claims automation. The work also then touches overlap between salvage yards and insurers. Repairify is another Claim Genius partner.

“Anybody and everybody who deals with” vehicles needing repair. “How was the vehicle before and after,” Pofale said.

Proov Station Subhead

Balas said 25 Proov Station scanners are in nine U.S. airports, mainly in the Southeast — its U.S. office is in Miami — along with Maui and Portland. In the U.S., Proov Station works with car rental company Sixt; in Europe it works with Hertz, Enterprise and Europcar, along with several larger auto dealership groups.

“Two main use cases are dealerships and fleet inspections,” Balas said. “We want to duplicate in the U.S. what we’ve validated in Europe.”

With larger operators — UVeye is in Tom Wood Group’s 75,000-square-foot collision center in Indianapolis — Proov could also find overlap with its model.

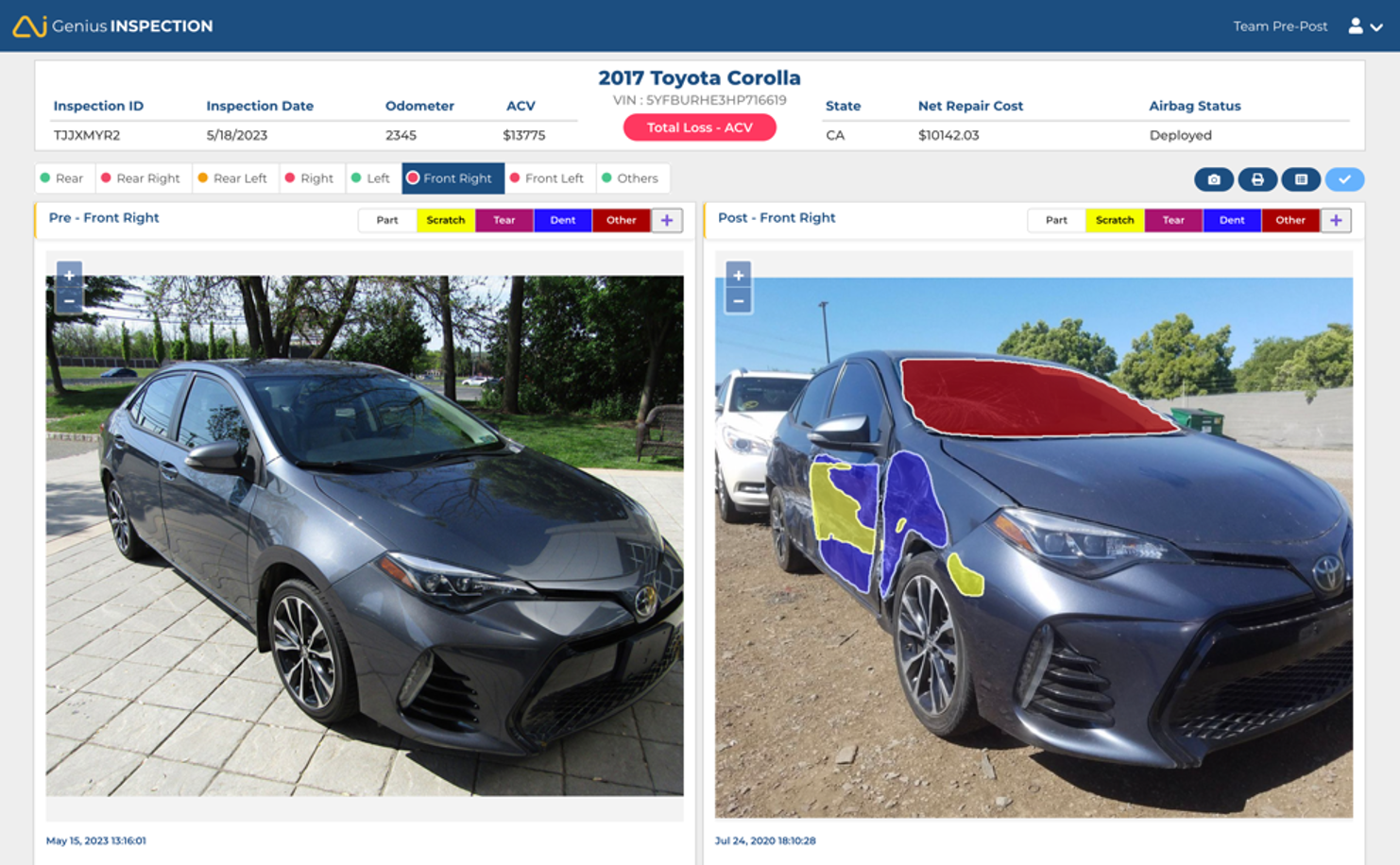

Screenshot of a Claim Genius scan.

Screenshot of a Claim Genius scan.

Pittsburgh-based Aero Corp. has 4,000 Avis and Hertz vehicles at 35 locations in five states, while also being a CARSTAR franchisee and a certified Tesla repairer, a press release said.

Proov Station “runs everything on the cloud,” and is “connecting our solution to other [client] platforms.”

“Detecting damage is great to start but that just raises the opportunity: you have to convert them” to customers. “So we also worked on connecting with dealer systems, end-to-end.”

This means the body scanner — with roof, tire, and underbody as options — detects issues, and communicates with other software to “automatically check the stock, and generate quotations.”

Balas said sales training and workflow is also vital. People who drop off cars in the morning “don’t have time” then to decide on all possible repairs. “That needs to be a synchronized process” through the day.

Costs and Value

Gabriel Tissandier founded Proov Station in 2018; he developed an early mobile app for this work in Europe that doesn’t use AI. The two companies are separate and Proov Station isn’t pursuing app use in the U.S.

“It’s basic,” Balas said, “and there are plenty of apps that do it better. Coming to the U.S. with scanners, that’s where there’s value for customers.”

Overseas, company hardware leases for about 3,000 euros a month — roughly $3,500 —plus about $1.75 per scan, for three to five years.

Claim Genius tailors fees “to the size and scale of repair facilities, ranging from a few hundred to a thousand dollars a year,” according to Pofale.

He sits on a CIECA Standards Development Committee focused on AI with Jimmy Spears, head of automotive AI at Tractable.

“I’m a great advocate of AI in the collision industry,” said Pofale. Of his committee work he said, “Our job is to educate and set expectations of using AI, what to expect, what is really possible, and how it should produce.”

In line with AI’s unique offer overall, these efforts involve not so much new information as faster computation. Norway-based Wenn, for instance, also grew in part from its founder’s desire to slash time required for starting repairs, including envisioning 24/7 availability and accessibility of its scanners.

Paul Hughes