I know a lot of shop owners are focused right now on making sure they have enough work coming into their shop. But I was looking at some data recently that I think is important for the industry to understand related to wages and labor rates.

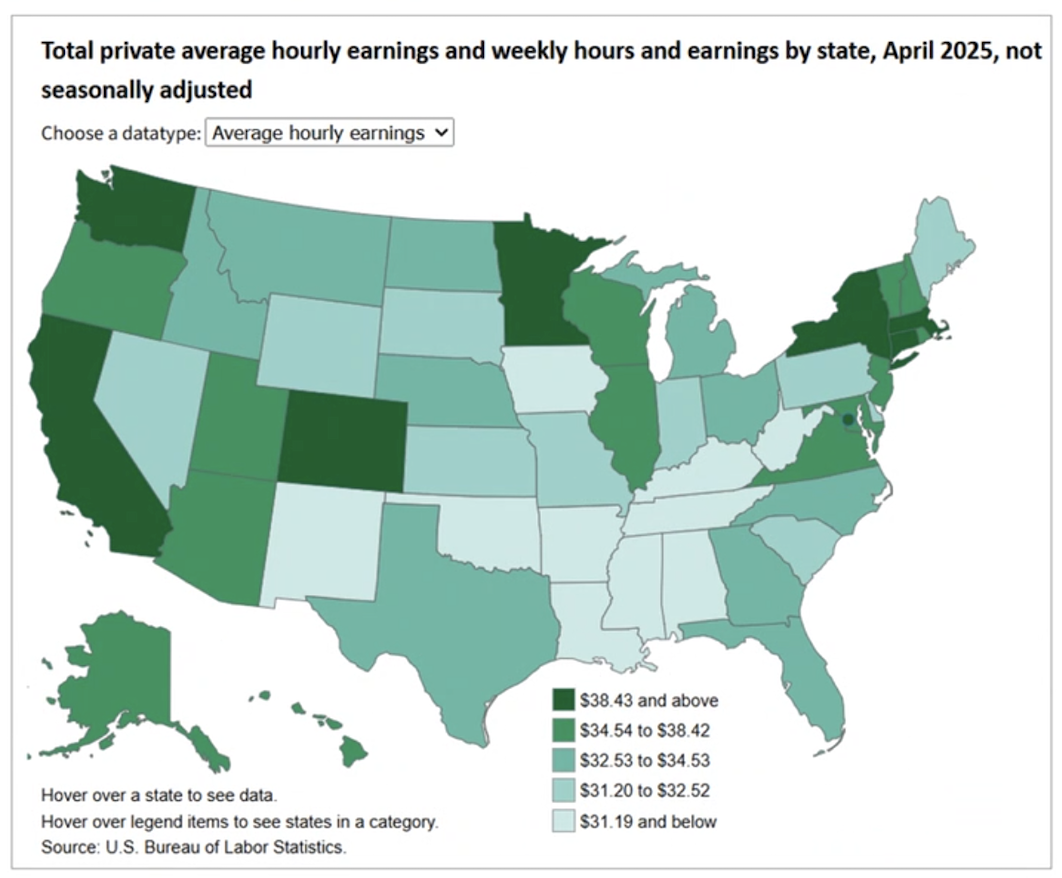

First, I saw U.S. Bureau of Labor Statistics data on the average hourly earnings for each state. This is for all workers in a state, not just those in our industry, and the data was from this past April.

On the low end, there are maybe a dozen states where the average hourly rate is $31.19 or less. But the vast majority of states have average hourly earnings above that, including about a half dozen states where the average tops $38.43 per hour. Visual Capitalist has a similar map, showing the actual average in each state. For the state of Texas, for example, the average hourly earnings are $34.49 per hour.

Another chart, from Statista, shows the minimum wage in each of the 50 states. In New Jersey, minimum wage was $15.49 last year — and it was even higher in five other states and the District of Columbia.

Beacon Economics reports the national average wage for restaurant workers in Q4 2024 was $18.30. That was up almost 38% over five years. Gasoline station workers? $19 a hour, up 33% over five years.

So when someone in our industry tells me they can’t get good people, I think we have to consider what they’re offering in terms of pay. The days of paying someone $500 to wash cars is out the window.

Think about your other labor costs. I know personally my health insurance just went up for at least the fourth or fifth year in a row.

I think shop owners really need to sit down and figure out what their current cost of doing business is. You can't just say, hypothetically: well, I'm paying a technician $30 an hour. You may also be providing them with paid vacation, however many weeks they get, or contributing 3% to their 401(k). Think about your payroll taxes, like the federal or state unemployment taxes (FUTA and SUTA). I don’t think a lot of shop owners really know what their actual total cost is for an employee.

Even if you figured this out some years ago, think about what’s changed over time. Technicians now are replacing more parts and repairing fewer. That has an impact on technicians’ efficiency, which makes it even more important to capture not-included operations — and have a proper labor rate — to make up for that change in efficiencies.

Has your labor rate kept up with wage inflation? Let’s say your labor five years ago was $52. Even just a 25% increase over five years — a rate lower than the increase for a lot of categories of workers — would have added $13 to that.

Think about this: Even with a lower claims count, your overhead likely isn’t going down, so you may have fewer jobs with which to cover that expense over fewer jobs.

My bottom-line message is this: Take a fresh look at your labor rates. Insurers, too, need to understand: Shops can’t repair vehicles if they can’t attract and retain the talent needed. Shops can’t do that if shops are not compensated fairly.

So at the end of the day, either labor rates have to start to come in line with what we need to compensate more fairly, or shops have got to be paid for more not-included operations — or some combination of the two.

Mike Anderson