Disconnecting and later reconnecting a vehicle’s battery during collision repair work is no longer the simple operation it used to be---and auto body shops are increasingly understanding the need to research the OEM procedures for doing so, and seeking to be paid for the labor entailed.

That was among the findings of a “Who Pays for What?” survey in 2021. The survey of more than 500 shops around the country last summer found about 61% of survey respondents reported being paid “always” or “most of the time” by the eight largest insurers when they performed and invoiced for the procedures required to reconnect a battery.

Overall, the eight insurers included in the survey proved fairly similar in terms of likelihood of covering the bill for this work. But all eight insurers appear to be more likely to reimburse their direct repair shops for this procedure.

This was particularly true in the case of State Farm. More than half (55%) of State Farm DRP shops said they were “always” paid by the insurer for this operation, but only 23% of shops not part of State Farm’s DRP said they were. Additionally, 24% said State Farm “never” pays them for this procedure.

When shops were asked a follow-up question about how often they research the OEM repair procedures necessary after a battery is reconnected, just more than half (51%) said they do it most or all of the time. But more than one in four (28%) acknowledged they research the proper procedure only “occasionally” or even “never.”

“Researching procedures required when the battery is disconnected and reconnected is critical to a safe and proper repair,” Mike Anderson of Collision Advice wrote in the report with the survey findings. “I was analyzing the procedures called for by one Asian OEM recently, and found 11 procedures required after reconnecting the battery. Disconnecting the battery often will set diagnostic trouble codes (DTCs). You can’t check for those without doing a post-repair vehicle scan in conjunction with reconnecting the battery.”

The first of the four “Who Pays for What?” surveys of 2022, one focused on not-included refinish labor operations, is being conducted throughout January; shops can click here to take the survey.

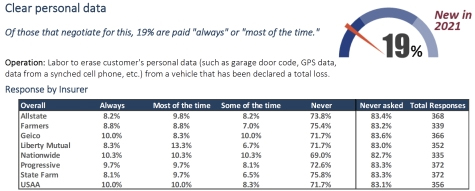

Last summer’s survey also found although a majority of shops surveyed said they had not yet billed for the time entailed in clearing customer data from a total loss vehicle, some of those who have reported the largest insurers were paying for those charges.

“Clearing the vehicle owner’s personal data from a total loss vehicle is something we need to start thinking about for our customers,” Anderson said. “A vehicle owner today may have their home address stored in their navigation unit of the vehicle. Their contacts can be stored when they sync their phone. Garage door opener codes might be stored. So we need to be asking the vehicle owner, when the vehicle is a total loss, if they would they like us to erase their personal information. The process for this can be found in the owner’s manual.”

Fewer than 20% of the auto body shops answering the survey question last summer said they had sought to be reimbursed for the procedure by eight of the nation’s largest insurers. Among those who did, just 19% overall found insurers covering the bill “always” or “most of the time”---and most of those involved non-DRP repairs.

Anderson thinks that will change over time as the industry becomes more aware of the need for the procedure to be performed, and as more shops regularly bill for it.

The survey also found administrative fees for total loss processing have become increasingly common. Direct repair agreements often prohibit participating shops from charging administrative fees related to processing of total losses. California shops are also prohibited by state regulation there for charging administrative fees.

But the “Who Pays” survey last summer found the percentage of U.S. shops saying they are paid such an administrative fee has risen, with a strong majority (72%) saying they are paid always, or most of the time, when they bill for this work. That compares to just 46% back in 2015.

Likewise, the percentage of shops that say they have never billed for this fee also has declined steadily since 2015. Today, only 11% say they never charge a fee to process a total loss, but in 2015, that figure was 30%.

“Processing a total loss has become more complex than it used to be,” Anderson said. “It can involve more teardown, more research of OEM procedures, vehicle scans and more.”

According to the 2021 survey, 74% of shops itemize charges---as opposed to charging a flat fee---for total loss processing. In addition to the administrative time, these charges may include moving a non-drivable vehicle, covering the vehicle to protect it from weather, etc.

Back in 2015, 38% of shops believed the top eight largest insurers in the “Who Pays” surveys “never” paid an administrative fee for total losses. Today, only 17% still think so.

The “Who Pays” surveys also ask about a variety of other collision shop billing practices. A growing percentage of shops, for example, say they are using an invoicing system to track and bill for items such as clips and fasteners, seam-sealer, eraser wheels or other shop supplies used during a repair.

Slightly more than half of shops (54%) in last summer’s survey reported using some kind of commercially available invoicing system, such as those available from 3M, Kent Automotive or Wurth. That’s up from 41% in 2017.

“Many of the items these systems can track, and generate an invoice for, are often inexpensive but one-time use items that may not seem worth tracking, like acid brushes or mixing nozzles,” Anderson said. “But added all together, it can be a sizable unreimbursed expense.”

Virtually all shops (93%) using a system reported doing so generates additional revenue on their estimates.

The survey asked shops to quantify that additional revenue. The largest group (37%) said it generates an average of more than $50 of additional revenue per estimate; the next largest group (29%) said between $26 and $50 per estimate.

John Yoswick