During a recent CIECA webinar, Ryan Mandell, director of claims performance for Mitchell International, presented his thoughts on how tariffs will affect the collision industry. In his role, Mandell works frequently on consultancy with industry material damage leaders.

He called the subject of impending tariffs a “very volatile, very important” one “that really has the potential to disrupt many of our organizations.”

That potential volatility, he said, is driving widespread uncertainty about the economy, and present in that overall feeling are fears about how tariffs will impact collision repair and its intertwined relative, auto insurance. The CEICA audience was on hand to hear about how tariffs will affect the automotive supply chain and the impact that will have on total loss, the cost of parts and more.

Constant Changes

Changes surrounding tariffs, Mandell said, are emerging “minute by minute, hour by hour,” so his content was based on the information he had at the time of the session.

“This can change on a dime as we've seen many times in recent history. We are doing this to really help provide some more clarity about how these tariffs are going to impact the industry, what it means for whole vehicles -- actual parts, specifically -- and to provide you some insights into some ways that this could be quantified,” he told the CEICA audience. “What you're seeing today is our interpretation of what of the research that we've done on the specific topic and with a heavy reliance on Mitchell data.”

He encouraged listeners to consult with professional and legal advisors before implementing strategies he discussed regarding tariffs.

Tariff Scope and Effect

Tariffs, Mandell explained, are being enacted under section 232 of the Trade Expansion Act of 1962, which allows the U.S. government’s executive branch to reapportion trade arrangements based on perceived threats to national security.

Screenshot from the CIECA webinar.

Screenshot from the CIECA webinar.

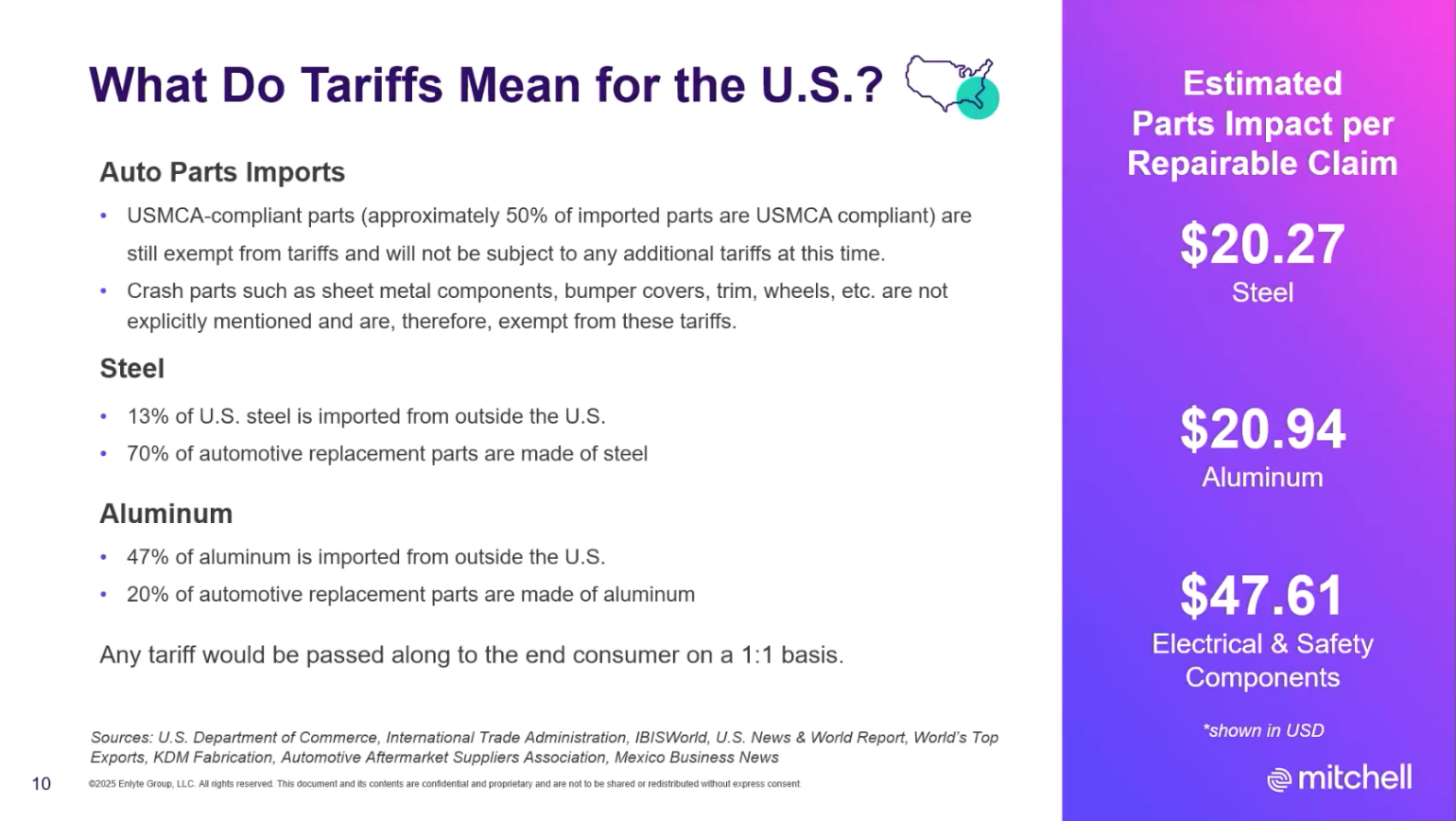

The current presidential administration, he said, looks at increased at-home auto manufacturing as an improvement to national security and is using that concept as the genesis of the current tariffs on whole vehicles coming into the U.S. He referenced the 25% tariff on whole vehicles entering the country that went into effect April 3 and a 25% tariff set to commence in May for auto parts.

The United States-Mexico-Canada Agreement, however, narrows the scope of these tariffs significantly, Mandell said. At this point, he noted, USMCA-compliant goods will be tariff-free. The percentage content of vehicles that aren’t compliant will be subject to tariffs, though. This rule will require examination of certificates of origin, which is not a standardized form but rather is something individual manufacturers create when looking at where goods come from. Incorrect classification, Mandell said, could result in whole vehicles becoming subject to the 25% tariff.

Around half of parts imported to the U.S. are USMCA compliant, he said.

No vehicle manufacturer is immune to tariffs, Mandell pointed out, but some brands may face heavier exposure. According to National Highway Traffic Safety Administration data, some car companies rely nearly completely on foreign production. Where vehicles are assembled affects whether they’re subject to tariffs. Mandell pointed out that vehicles assembled in other countries rely on infrastructure there and are less likely to be USMCA compliant than vehicles assembled stateside, where factors like trim level with components from other countries can still affect compliance.

“The takeaway here is that just looking at the brand does not necessarily give you all the insights that you need,” Mandell said.

Domestic brands that were relying heavily on overseas manufacturing and expanding that practice prior to the tariffs, he said, may not be going that direction at this point.

“I think these tariffs that are being instituted are going to be prohibitive for manufacturers to look at expanding their footprint in China to something where you would see more globalization of some manufacturing, even for domestic brands prior to the institution of these terms,” he said.

Cost Increases

Mandell used the 2025 Hyundai Elantra as an example of a vehicle with more than 90% of its contents coming from Korea and final assembly taking place there. Assuming the entire vehicle will be subject to a 25% tariff, with a base value of just over $22,000 and rough wholesale value of 15% below base MSRP, he arrived at a value that would be subject to the tariff.

“If we kind of play this out and add in that tariff, what we see is the adjusted wholesale value now becomes $23,507 when it's imported into the U.S., so when the dealer takes it to their market now, we see an adjusted MSRP of a little over $27,000 on that same deal,” he said.

This scenario assumes the entire tariff cost goes to the consumer, which he said may not hold true in the end.

“There are strategies that OEMs and dealers have at their disposal to potentially adjust some of these values and limit that exposure to the end consumer,” he said, calling tariff scenarios “very vehicle-specific.”

Reports from the industry put the extra cost for consumers between $2,800 and $12,000, depending on the make and model of vehicle, he said.

“What this does is this raises new vehicle prices,” he posited. “What you will see is more demand going into the used vehicle market, and this is something we saw during COVID. When there was reduced supply of new vehicles, people started to flock to that used vehicle market … What we're already seeing is that right now people are flocking to the new vehicle market to try to take advantage of vehicle pricing that does not have tariffs already applied.”

Some manufacturers have announced they’ll reduce production wages if they’re producing fewer vehicles for U.S. import, Mandell said.

With increased projections on used car purchases, average ages of cars on the road will probably rise, along with an increase in spending on maintenance of vehicles. Over time, parts price changes could come into play, depending on type and place of manufacture.

Looking again at the Hyundai Elantra, Mandell examined total loss ratings. He used a 70% actual cash value threshold for repair to consider a pre-tariff vehicle. Examining adjusted dealer MSRP means the threshold increases by nearly $3,500, leaving more room to fix the vehicle.

Mandell predicted that over time, as more vehicles are subjected to tariffs and see rises in price, there will be a reduction in overall total loss frequency -- possibly between one and three percentage points. Rises in new vehicle prices, he pointed out, could eventually have a trickle-down effect on used vehicle prices.

He also predicted an increase in demand for salvage vehicles as the rebuilder market picks up. Recycled parts are a way to offset tariff exposure, so there may be increase there, which may also drive demand for salvage vehicles.

Tariffed and Non-Tariffed Parts

Mandell pointed out that not all parts would be subjected to tariffs. Some of the more significant parts not subject to tariffs include, he said, structural sheet metal like hoods, fenders, doors and quarter panels.

“That really does actually negate some of the cost increases that we were previously looking at,” he said.

The presidential administration has expanded on its initial list of tariffed parts, which fell into four categories: engines, powertrains, transmissions and electrical components. Specific included parts that will impact the collision industry, Mandell said, are headlamps and taillamps, ADAS components like sensors and cameras, airbags, seat belts, bumper reinforcements and absorbers. A miscellaneous category will include things like air conditioning components and windshields.

Affected companies, he said, may transfer some manufacturing to the U.S., potentially making for lag in production as setup commences.

“You can't just start up a new manufacturing facility overnight,” he said. “This is something that takes years to happen, so there could potentially be disruptions as some of that work takes place over the coming years. This may not just be a short-term issue.”

The impact of tariffs on parts could precede impact on whole vehicles, he said, because OEMs dealers carry less onshore stock than most aftermarket providers, which are likely to keep a few months’ with of inventory onshore. He predicted impacts to be evident by mid to late summer, depending on the manufacturer. Manufacturers with lower tariff exposure may capitalize on that position with price points that appear more favorable to consumers, he said.

Boiling all of this information down, Mandell said, means rise of cost of repair is “definitely” on the horizon. That’s alongside other inputs, like paint and abrasives, for which cost will likely rise, as China is a primary supplier of key components in these items.

Higher-dollar repairs, as opposed to total losses, combined with higher parts estimates could result in a severity increase of around 4%, he posited, citing a similar phenomenon during COVID.

Mitigation Strategies

Canada and the U.S. are significant trading partners, Mandell pointed out, with 62% of Canada’s auto parts imported from the U.S. Canada recently announced it will not place additional tariffs on parts coming in from the U.S. He called this move a “big benefit for the Canadian market” but said it’s unclear what the process will be for goods that are imported to the U.S. from, say, overseas initially and then to Canada.

Mandell laid out mitigation for insulation against the detriments tariffs pose in several forms. The first, he said, is to up supply chain transparency and understand how vendors move goods and where these goods are going at all stages.

Utilization of recycled parts also makes sense, since they’re sourced domestically from salvage vehicles dismantled stateside. But there could be an increase for recycled parts as demand goes up, he said.

For insurers looking at mitigation, rates might increase across the board with regulatory approval, Mandell posited. Smaller claim numbers may shrink if consumers have dropped coverages to increase affordability or deductibles go up and minor claims don’t make financial sense.

Elizabeth Green