A shift in consumer driving behaviors since the pandemic, the rise of AI and labor shortages are some macroeconomic trends impacting the collision industry, according to the 28th edition of CCC Intelligent Solutions’ Crash Course Report, “ignite EXPERIENCE.” Meanwhile, there are advancements in vehicle technology, including advanced driver-assistance systems (ADAS) and electric vehicles (EVs), said Jason Verlen, CCC’s vice president, product marketing.

“The macrotrends are having effects on how the industry functions,” said Verlen. “The industry is changing quickly.”

Subtitled “The Era of Experience,” Crash Course 2023 includes data from 260 million claims-related transactions, 50 billion miles of driving data, and millions of auto physical damage and auto bodily injury and personal injury protection (PIP)/medical payments (MedPay) casualty claims data and analysis.

Verlen shared learnings from the report and the impact to the industry and consumers.

How are this year’s findings different than prior years?

The transition is more profound in terms of what's happening with repairs and claim times. These are significant changes that are staggering. This is not the usual market change. In addition, it’s what repair facilities and insurers are doing in the face of these shifts that readers will find interesting.

What are some macrotrends discovered?

The macrotrends include where people live, what cars they drive, how they drive and how technology like AI is changing their experience with vehicle ownership, insurance claims and repairs. Another macrotrend is what the labor force looks like. These have clear, demonstrable and profound impacts on the claims repair ecosystem. The ramifications are deep, and from my perspective, I don't think these issues are going anywhere anytime soon.

There is generally less congestion on roadways since the pandemic and peak driving volume is occurring on different days and times. In the top 10 U.S. cities, miles traveled are roughly the same. It may even be up a bit, but downtown, it is 27% below the usual. This is due to more of a balance between hybrid work and going to the office, and more people living in rural areas and driving during non-peak hours. We found that migration to rural and small towns has increased to a record 48%.

People are also driving very differently. They are driving faster and are more distracted. This can be attributed to texting, as well as cannabis and alcohol use. Alcohol use is up and many states are looking to change the DUI measure from 0.08 to 0.05.

This affects Delta-V, which is the change in velocity between pre-collision and post-collision trajectories of a vehicle and indicates accidents are getting more severe.

New vehicles are not just bigger, but heavier and have more horsepower. We found people are driving more trucks with an average of more than 300 horsepower. The average internal combustion engine (ICE) vehicle has 1,500 semiconductors, whereas an EV is double that. When they are in accidents, there are definite ramifications.

What is taking place with repairs?

Costs continue to climb. Over the last five years, they have increased from an average of $3,000 per claim to $4,000. This is partly due to new technology. More parts and labor are on the average claim. Typically, parts consist of varying materials and many incorporate digital technology, which makes them more expensive to buy and repair.

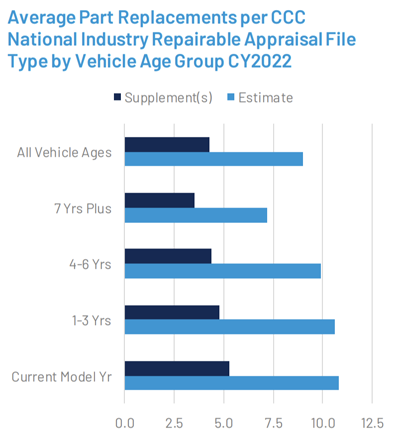

The average number of parts on a claim five years ago was nine; in 2022, it was 13. It comes down to complexity. When you look at a diagram of a front bumper from 10 years ago, it might have three or four obvious pieces. A front bumper today is double or triple that. It begins to add up when you have more parts to assemble and the growing need for diagnostic scans and performing a calibration to ensure everything is repaired correctly.

There are also more supplements. Roughly 60% of claims now have a supplement. If you look at data from 20 years ago, I believe it was 20%. As unbelievable as it sounds, about 5% of claims have four or more supplements. The cost of the supplements has almost doubled over the last five years from $500 to $900.

Another shift is the amount of mechanical labor required. About 40% of claims on new vehicles require more expensive mechanical labor, which is double than five years ago.

With the amount of digital technology in new vehicles, we’re now seeing a diagnostic scan included in the initial estimate. We wouldn’t have seen that years ago, but the computer systems in cars today need special tools to identify and diagnose damage.

There are more situations where parts are replaced that would have been repaired years ago due to the electronics inside. In some cases, there are more OEM parts with sophisticated electronics. That increases costs and repair time.

How are these changes impacting labor?

The labor shortage, both for carriers and shops, is a huge challenge at the wrong time because of the dynamics of the vehicles themselves combined with how people drive.

Insurers and repair facilities are becoming more creative in figuring out how to handle the situation. We are seeing carriers being more flexible in hiring people who are not necessarily in the areas where they have their offices and working remotely. Repair shops, especially MSOs, are becoming more aggressive in setting up training programs to bring people on board.

Additionally, the rise of AI is making the claims process more efficient. The use of photo estimating, for example, has increased since the pandemic. About 27% of repairable vehicles go through the photo estimating process; indeed 150 carriers send CCC photos and approximately 100 apply AI to those photos. Over 14 million claims have used this technology since it was deployed.

One advantage of using AI is the superior process. If a carrier sends photos to a repair facility, it can apply AI to build an initial estimate and repair plan for the repair professional to review. AI also aids new employees coming into the industry who have less experience than their predecessors.

How are these changes impacting consumers?

They affect customers because they affect cycle time. We have complicated vehicles that are expensive to repair. They require more steps, diagnostics and calibrations and there is less labor to do it.

This impacts customers getting their car into a repair shop. Many facilities now have a waiting list of over a month. There’s no magic to shrinking those backlogs but there are steps shops can take, like getting more labor on board, getting more comfortable repairing these vehicles and transparency with customers.

There’s a big difference between a consumer waiting for a car that's not functioning correctly and one that's getting messages about the status of how the repair is progressing.

If a repair isn’t done transparently and there are delays and supplements, that’s frustrating for a customer. If the repair process is transparent, even in a challenging environment, a consumer is more likely to give the repair shop the benefit of the doubt.

To read the report, visit cccis.com/crash-course.

Stacey Phillips Ronak