National News

National News

Regional News

Keep up with the latest collision repair industry news in your area.

Regional News

Keep up with the latest collision repair industry news in your area.

Industry Press Releases

Industry Press Releases

Top Stories

Top Stories

Sponsored Content

Sponsored Content

Featured Video

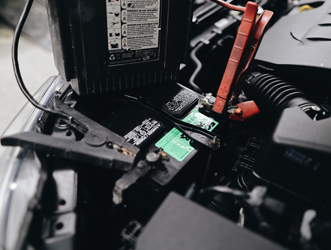

Fix Your Wiring Harness Fast with Solder & Shrink-Wrap!

Discover the secrets to perfect wiring repairs. Learn solder and shrink-wrap techniques at FindPigtails.com!

Shop & Product Showcase

- Read testimonials from real collision repair shops about the tools and technologies they use to get the job done.

Current Digital Issue: August 2024

Autobody News is a free monthly publication for the owners and managers of 36,000+ collision repair shops across the country.

Click on the regional area of your choice or subscribe here.